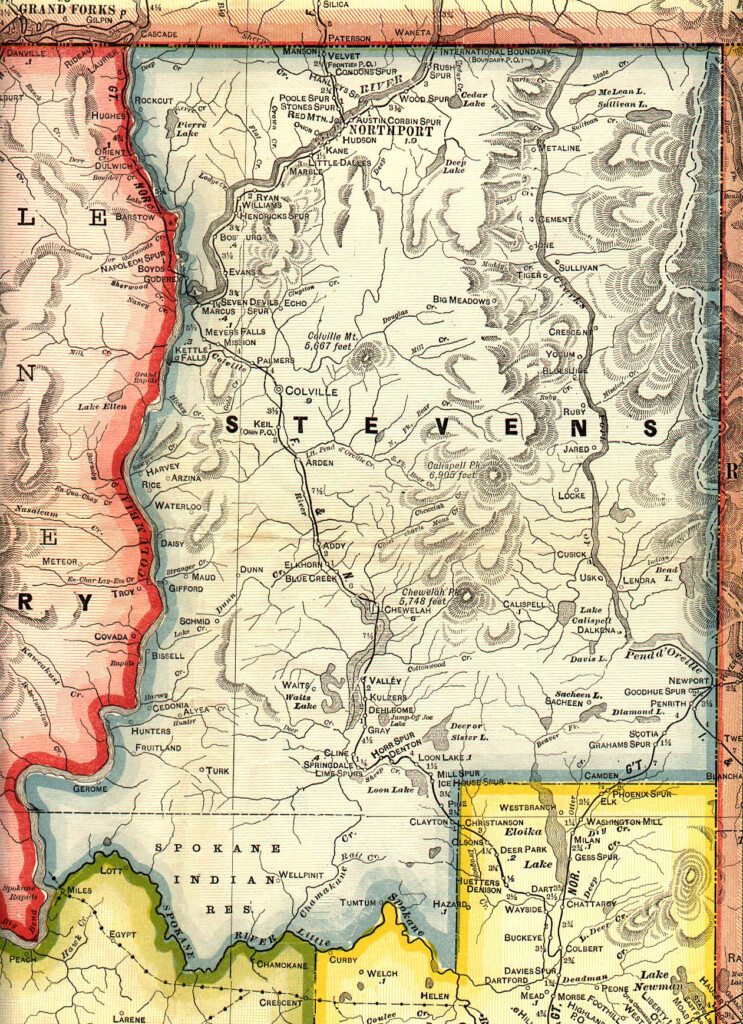

Henderson County Tax Map – You should be mindful of the importance of using a tax map for your county when you are an owner of property or a company owner. The key component of a tax map of a county, parcel mapping, is crucial for timely tax payment. It can also assist in maintaining the property’s value.

mapping of the cadastral parcels

Cadastral parcel mapping is essential for the assessment of real estate. It assists the assessor in the identification of each parcel of land and issuing an Identification Num. Identification Num.

This is done using the parcel’s dimensions, form and location. The map shows the connection between the parcels. These plots can be taxed or exempt.

During the tax mapping procedure the entire area which will be taxed has been established. Every piece of taxable property should be listed on the tax map. The map should be frequently updated.

It is essential to alter the tax map in order to alter the physical dimensions, or the forms of parcels. Revisions are also necessary in the event that the parcel’s number change.

Tax maps show the value and location of every tax-exempt property within a particular county. Every local assessor is supplied with tax maps from the county. They assist the assessor in create the assessment roll.

Precision of county parcels

A variety of factors influence the accuracy of parcels shown on county tax maps. The first one is the source. To establish parcels, it is possible to make use of deeds and subdivision plans along with survey results. The information in a package may thus be incomplete or out of date.

The precision and completeness of parcels shown on a map depend on the source information and the map. Because of this, counties may have various specifications for accuracy of maps. Contrary to hand-drawn maps that are still in use in some counties, modern mapping software typically shows more accurate parcels.

The assessed valuation of the property as well as any easements or titles that are connected to it are all part of the data for the parcel. This information is what most counties need most. All information being available in one location is easy to find which increases the efficiency of both enterprises and residents.

In reality, county parcel data is an effective tool for economic development. A parcel’s information can be utilized for planning, tax assessment, and even for emergency response.

Tax Map for Sullivan County

It’s a PDF document which opens within your browser. The Sullivan County Tax Map can be quite large. A printout of the Sullivan County Real Property Services Office is available for those who want the map printed. The size of the file will determine how long it takes for it to be loaded.

The Sullivan County Tax Map should be used as a guide. It includes roads, rivers, forests, as well as game land. Look up your county tax parcel book for a an accurate map of your property. The premium service is intended for people who need a lot of maps.

While the Sullivan County Tax Map lacks an official name however, you are able to submit the necessary request to the Sullivan County Clerk’s office and the County Real Property Tax Service. The clerk, in addition to his tasks, is responsible for the registration of deeds.

Tax Maps for Chautauqua County

Access to the west of New York State is provided via Chautauqua County. The county has six lakes, farmland, as well as the processing facility for food. In the middle of the county is Chautauqua Lake which eventually flows into the Gulf of Mexico.

The Eastern Continental Divide passes through this region. It empties into Conewango Creek. Although there is only one area within the county that is more than 25 miles away from open water, Conewango Lake provides a significant supply of drinking water for the villages around it.

Chautauqua County has fifteen communities. Mayville is the county seat. Small towns like Mayville are hardworking, although they’re not huge. There are numerous shared services, which has led to increased efficiency.

The county-wide shared services plan, which gave low-hanging fruit projects the highest priority, was enacted by Chautauqua County. This is a significant advantage for municipalities. The strategy anticipates saving the county more than 1 million dollars within the first year of operation.

Every county has a county-wide panel for shared services, thanks to the county’s shared services program. It is the duty of the panel with the executive in the development and implementation of an local share service strategy.